Invoice Financing (BETA)

Get your funds faster from any invoice created with Midtrans through our Invoice Financing service! In collaboration with PT Multifinance Anak Bangsa (mab.co.id), a part of GoTo Financial, you can receive your funds from outstanding invoices as early as D+1 (the next day) from the application date.

Please note that Invoice Financing is currently available exclusively for businesses with legal entities (PT, CV, etc.). By applying, you confirm that:

- You are a business with a legal entity.

- You are your business's authorized Person in Charge (PIC), applying for invoice financing.

- You allow PT MAB to contact you for the invoice financing application process.

What is Invoice Financing?

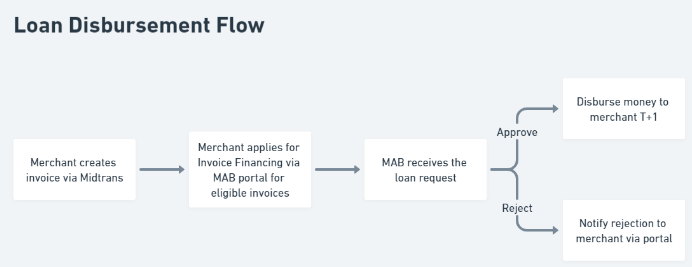

Invoice Financing, provided by PT Multifinance Anak Bangsa, allows merchants to apply for expedited payments for eligible invoices created through Midtrans.

Why Use Invoice Financing?

- Receive funds upfront, close to 100% of your invoice value (after deducting fees).

- High credit limit, up to IDR 30 Billion.

- Eligible for invoices with a payment term of up to 3 months (TOP).

- Competitive fees:

- Admin fee 0.5%.

- Interest fee starting from 1.5%.

- Tenor: Up to 90 days.

- No collateral is required.

Document Requirements

To apply, ensure you have the following documents ready:

- Akta Pendirian & SK Pengesahan KUMHAM along with the latest revision of the deed.

- Licenses (SIUP/TDP/NIB/others).

Company Tax ID (NPWP). - KTP or KITAS/passport of all members of the board of directors and commissioners.

- Financial Statements for the last 2 years and the last 6 months of bank statements.

- Credit facility application form and UBO form (provided by MAB upon onboarding).

Limited Release Period

During this limited release period, express your interest in participating in the rollout by completing the form. The MAB team will contact you with the procedures once the rollout begins.

Updated 4 months ago