Integration: Cardless Credit Payment

Cardless Credit is one of the payment methods offered by Midtrans. Using this payment method, the customers can shop online and make payments in installments. Midtrans sends real-time notifications to you when the customer completes the payment. Currently, Midtrans can integrate with Akulaku and Kredivo.

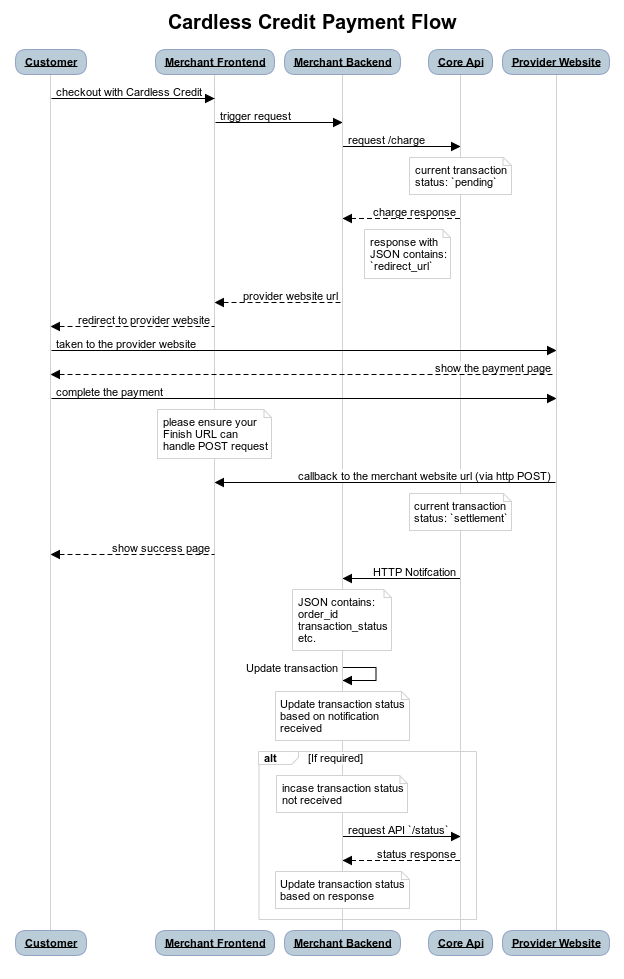

Sequence Diagram Transaction Flow

Kredivo Integration GuideGuide coming soon for Kredivo. In the meantime, please refer to Kredivo's Core API Reference

Sandbox Environment

The steps given below uses Midtrans Sandbox environment to test the integration process. Please make sure that you use the Server Key and Client Key for the Sandbox environment. For more details, refer to Retrieving API Access Keys.

Steps for integration

To integrate with Cardless Credit payment method, follow the steps given below.

1. Sending transaction data to Charge API

The Charge API request is sent with the transaction details, from the merchant backend.

Request Details

| Environment | Method | URL |

|---|---|---|

| Sandbox | POST | https://api.sandbox.midtrans.com/v2/charge |

| Production | POST | https://api.midtrans.com/v2/charge |

HTTP Headers

Accept: application/json

Content-Type: application/json

Authorization: Basic AUTH_STRINGAUTH_STRING: Base64Encode("YourServerKey"+":")

Midtrans API validates HTTP request by using Basic Authentication method. The username is your Server Key while the password is empty. The authorization header value is represented by AUTH_STRING. AUTH_STRING is base-64 encoded string of your username and password separated by colon symbol (:). For more details, refer to API Authorization and Headers.

Sample Request

The sample CURL request for Charge API for Akulaku Cardless Credit payment method, is shown below. You may implement according to your backend language. For more details, refer to available Language Libraries.

curl -X POST \

https://api.sandbox.midtrans.com/v2/charge \

-H 'Accept: application/json' \

-H 'Authorization: Basic <YOUR SERVER KEY ENCODED in Base64>' \

-H 'Content-Type: application/json' \

-d '{

"payment_type": "akulaku",

"transaction_details": {

"order_id": "order-101",

"gross_amount": 44000

}

}'POST JSON Body Attribute Description for Akulaku

| Element | Description | Type | Required |

|---|---|---|---|

| payment_type | Cardless Credit payment type. | String | Required |

| transaction_details | The details of the transaction such as the order_id and gross_amount. | Object | Required |

| order_id | The order_id of the transaction. | String | Required |

| gross_amount | The total amount of transaction. | Long | Required |

TipsYou can include more information such as

customer_details,item_details, and so on. It is recommended to send more details regarding the transaction, so that these details will be captured on the transaction record. Which can be viewed on the Midtrans Dashboard.

Learn more on why this API request should be securely managed from your backend.

Sample Response and Response Body

{

"status_code": "201",

"status_message": "Success, Akulaku transaction is created",

"transaction_id": "fa05cba0-8ea3-4e46-a2b1-daea2a01785c",

"order_id": "order-101-1578567480",

"redirect_url": "https://api.sandbox.midtrans.com/v2/akulaku/redirect/fa05cba0-8ea3-4e46-a2b1-daea2a01785c",

"merchant_id": "G812785002",

"gross_amount": "11000.00",

"currency": "IDR",

"payment_type": "akulaku",

"transaction_time": "2020-01-09 17:58:00",

"transaction_status": "pending",

"fraud_status": "accept"

}Response Body JSON Attribute Description for Akulaku

| Element | Description | Type | Notes |

|---|---|---|---|

| status_code | This is the status of the API call. | String | For more details, refer to Error Code and Response Code. |

| status_message | A message describing the status of the transaction from Akulaku. | String | |

| transaction_id | The Transaction ID of the specific transaction. | String | |

| order_id | The specific Order ID. | String | |

| redirect_url | The URL to which the customer is redirected from the bank's website. | String | |

| merchant_id | Your merchant ID. | String | |

| gross_amount | The total amount of transaction for the specific order. | String | |

| currency | The unit of currency used for the transaction. | String | |

| payment_type | The type of payment method used by the customer for the transaction. | String | |

| transaction_time | The date and time at which the transaction occurred. | String | It is in the format, YYYY-MM-DD HH:MM:SS. Time zone: Western Indonesian Time (GMT+7) |

| transaction_status | The status of the transaction. | String | For more details, refer to Transaction Status. |

| fraud_status | The fraud status of the transaction. | String | For more details, refer to Fraud Status. |

NoteThe

redirect_urlattribute for the transaction is received.

Status Codes and Errors

| Code | Description | Notes |

|---|---|---|

| 201 | Successful transaction. | – |

| 400 | The transaction_details are missing. | Make sure the order_id and gross_amount are included. |

| 413 | Syntax error. | Check the syntax. |

| 500 | Internal system error occurred. | You can try again later. |

2. Redirecting customer to Cardless Credit Website

The redirect_url retrieved from the previous step is used to redirect the customer to the bank's website.

You can redirect the customer through server-side redirect, using JavaScript like window.location=[REDIRECT URL], or using HTML link <a href="[REDIRECT URL]">Pay Here!</a>.

The customer can complete the payment on this page.

For more details, refer to Testing Payment on Sandbox.

3. Configuring landing page

After the customer completes the payment, the bank's website redirects the customer to Finish Redirect URL which can be configured on Merchant Administration Portal (MAP).

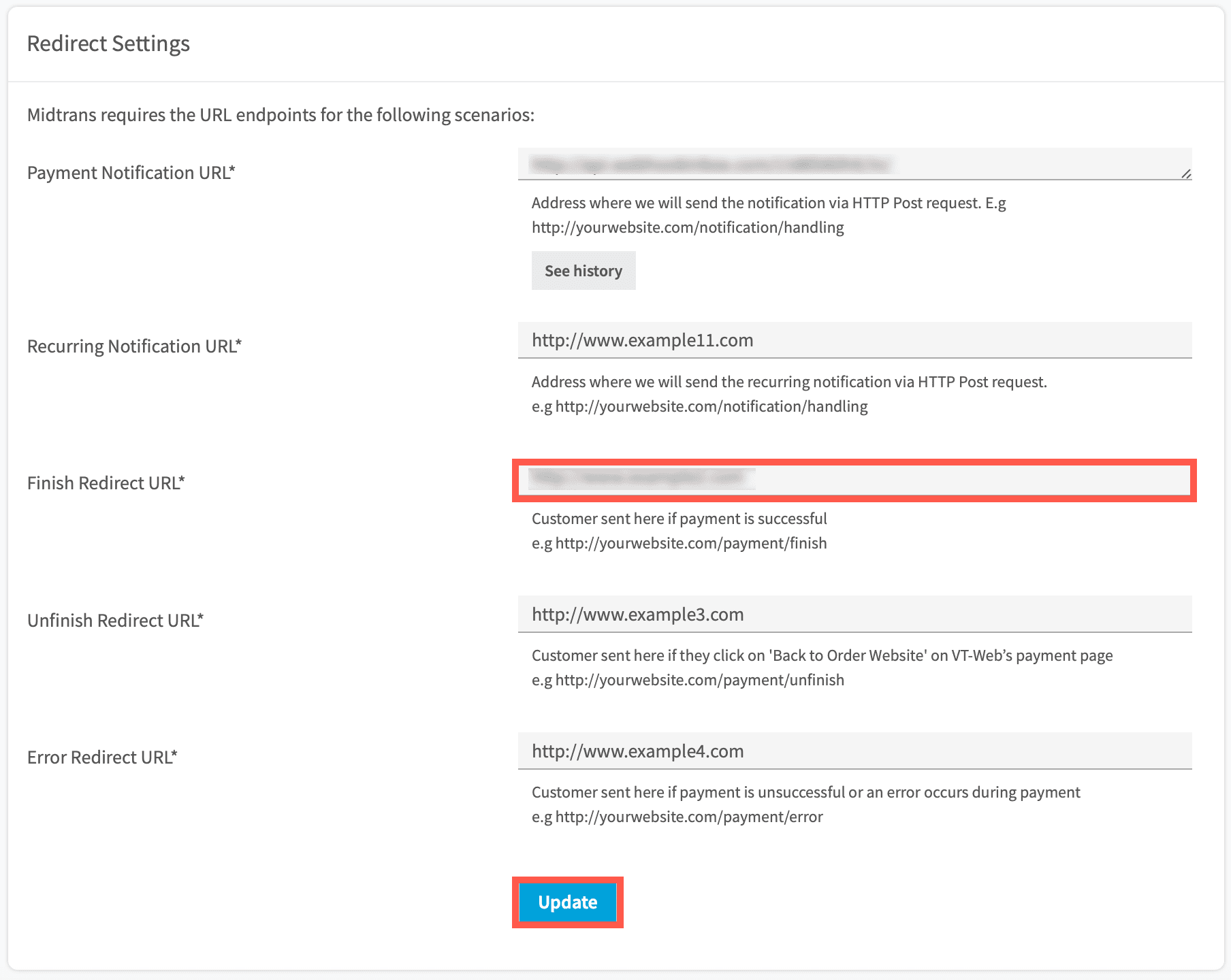

Configuring Finish Redirect URL

To configure the Finish Redirect URL, follow the steps given below.

- Login to your MAP account.

- On the Home page, go to SETTINGS > CONFIGURATION.

Configuration page is displayed. - Enter Finish Redirect URL with your landing page endpoint.

- Click Update. A confirmation message is displayed.

The Finish Redirect URL is configured.

Then, depending on which payment method, you should implement your Finish Redirect URL to handle the redirection:

Akulaku Landing Page

NoteThe redirection back from Akulaku to your Finish Redirect URL will be using HTTP POST.

Please make sure the Finish Redirect URL endpoint can receive HTTP POST request.

The sample implementation code in PHP is given below. Please adjust the code to your own tech stack.

<?php

// Read field `response` from the HTTP POST's Request Body.

$response = $_POST['response'];

// The value will be a String of JSON, so need to decode it into an object.

$decoded_response = json_decode($response);

// Then you can access the fields within that object.

$order_id = $decoded_response->order_id;

?># HTTP Request type: POST

curl 'https://<YOUR FINISH REDIRECT URL>' \

-H 'content-type: application/x-www-form-urlencoded' \

--data-raw 'response=%7B%22transaction_time%22%3A%222023-11-08+15%3A54%3A11%22%2C%22gross_amount%22%3A%2220000.00%22%2C%22currency%22%3A%22IDR%22%2C%22order_id%22%3A%22sample-store-1699433645%22%2C%22payment_type%22%3A%22akulaku%22%2C%22signature_key%22%3A%2201f8a501d52d87dfdbd2984009ed9740653fb79288ded6b3e50695308798682be113259529220d700571bb36afee4ed488c3769cc23275861863926efbc6b13e%22%2C%22status_code%22%3A%22200%22%2C%22transaction_id%22%3A%22e37e6f11-8f1f-436a-87fc-e3b938567d1d%22%2C%22transaction_status%22%3A%22settlement%22%2C%22fraud_status%22%3A%22accept%22%2C%22expiry_time%22%3A%222023-11-08+17%3A54%3A11%22%2C%22payment_channel%22%3A%22VTWEB%22%2C%22merchant_id%22%3A%22M007743%22%2C%22redirect_url%22%3A%22https%3A%2F%2FYourFinishRedirectUrl.com%2F%22%7D&callback_key=YourAPIClientKey'

# Decoded version of the HTTP Body

# response:

# {

# "transaction_time": "2023-11-08 15:54:11",

# "gross_amount": "20000.00",

# "currency": "IDR",

# "order_id": "sample-store-1699433645",

# "payment_type": "akulaku",

# "signature_key": "01f8a501d52d87dfdbd2984009ed9740653fb79288ded6b3e50695308798682be113259529220d700571bb36afee4ed488c3769cc23275861863926efbc6b13e",

# "status_code": "200",

# "transaction_id": "e37e6f11-8f1f-436a-87fc-e3b938567d1d",

# "transaction_status": "settlement",

# "fraud_status": "accept",

# "expiry_time": "2023-11-08 17:54:11",

# "payment_channel": "VTWEB",

# "merchant_id": "M007743",

# "redirect_url": "https://YourFinishRedirectUrl.com"

# }

# callback_key: YourAPIClientKeyKredivo Landing Page

NoteThe redirection back from Kredivo to your Finish Redirect URL will be using straight-forward HTTP GET.

Please make sure the Finish Redirect URL endpoint can receive HTTP GET request.

4. Handling post-transaction

When the transaction status changes, Midtrans notifies you at the redirect URL and sends HTTP notification to the merchant backend. This ensures that you are updated of the transaction status securely.

HTTP POST request with JSON body will be sent to your Payment Notification URL configured on Dashboard.

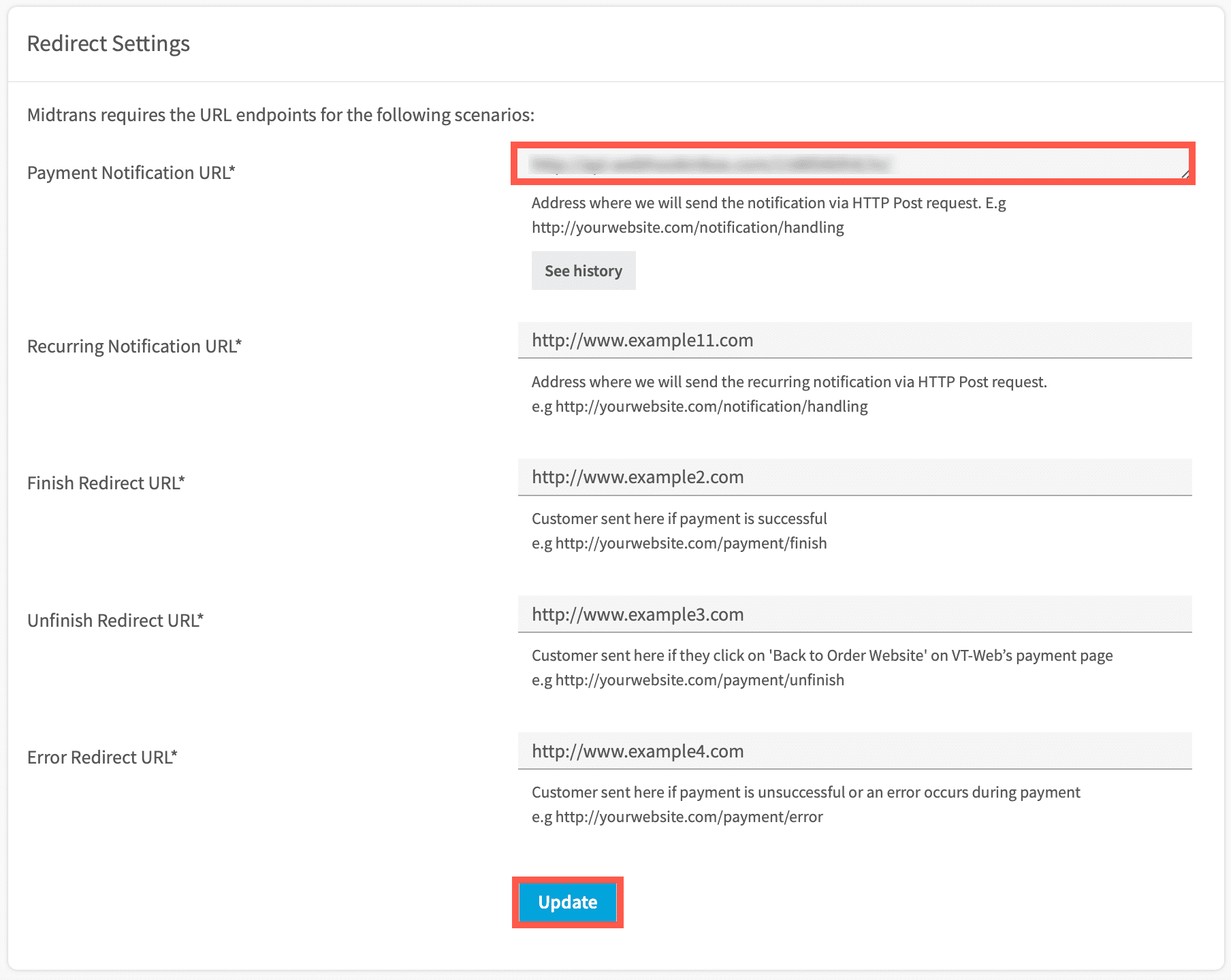

Configuring Payment Notification URL

To configure the Payment Notification URL, follow the steps given below.

- Login to your MAP account.

- On the Home page, go to SETTINGS > CONFIGURATION.

Configuration page is displayed. - Enter Payment Notification URL.

- Click Update. A confirmation message is displayed.

The Payment Notification URL is configured.

The sample HTTP notification request received at merchant backend for Akulaku Cardless Credit payment method is given below.

{

"transaction_time": "2020-01-09 17:58:00",

"transaction_status": "settlement",

"transaction_id": "fa05cba0-8ea3-4e46-a2b1-daea2a01785c",

"status_message": "midtrans payment notification",

"status_code": "200",

"signature_key": "331d8619f0c53ce97abf4cfc91fae8d8d0b11da1640b5bb136b0cfbc0da161d50fc6d0dd0d7f893977881710a2d2c174d9e036aaaa772e80fdeac6e9fb60e6b9",

"settlement_time": "2020-01-09 18:00:48",

"payment_type": "akulaku",

"order_id": "order-101-1578567480",

"merchant_id": "G812785002",

"gross_amount": "11000.00",

"fraud_status": "accept",

"currency": "IDR"

}See also : HTTP(S) Notification/Webhooks

Switching to Production Environment

Follow the steps given below to switch to Midtrans Production environment and to accept real payments from real customers.

- Change API domain URL from

api.sandbox.midtrans.comtoapi.midtrans.com. - Use Client Key and Server Key for Production environment. For more details, refer to Retrieving API Access Keys.

Updated 4 months ago